Sep 9, 2024

The 10 Slides You Need to Craft the Perfect Pitch Deck and Win Over Investors

Creating a great pitch deck is more than just presenting facts and figures—it's about telling a story that captivates investors and convinces them that your startup is worth backing.

In the early stages, investors wants to support a talented team building an innovative solution that addresses a significant problem in a large, growing market.

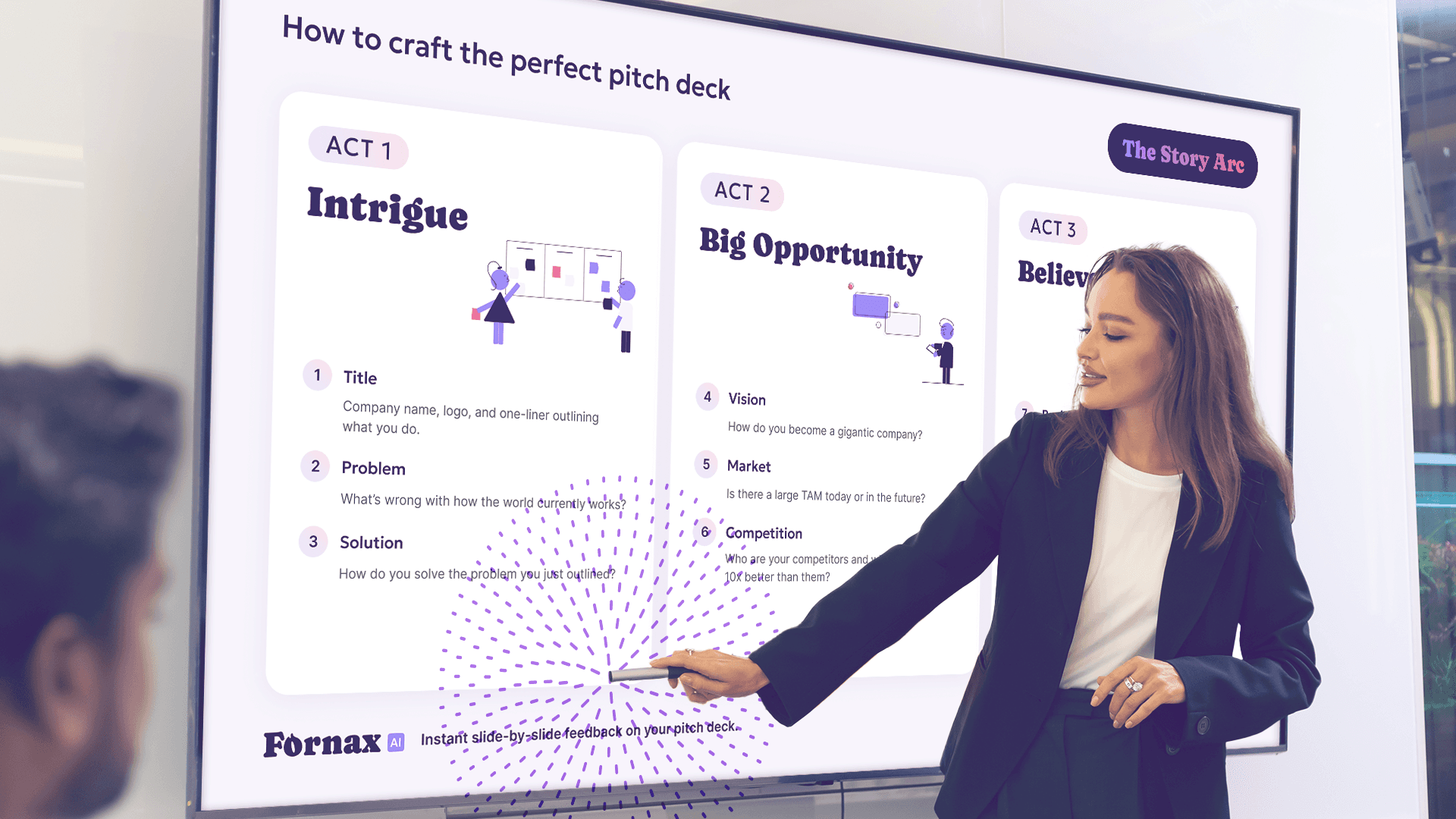

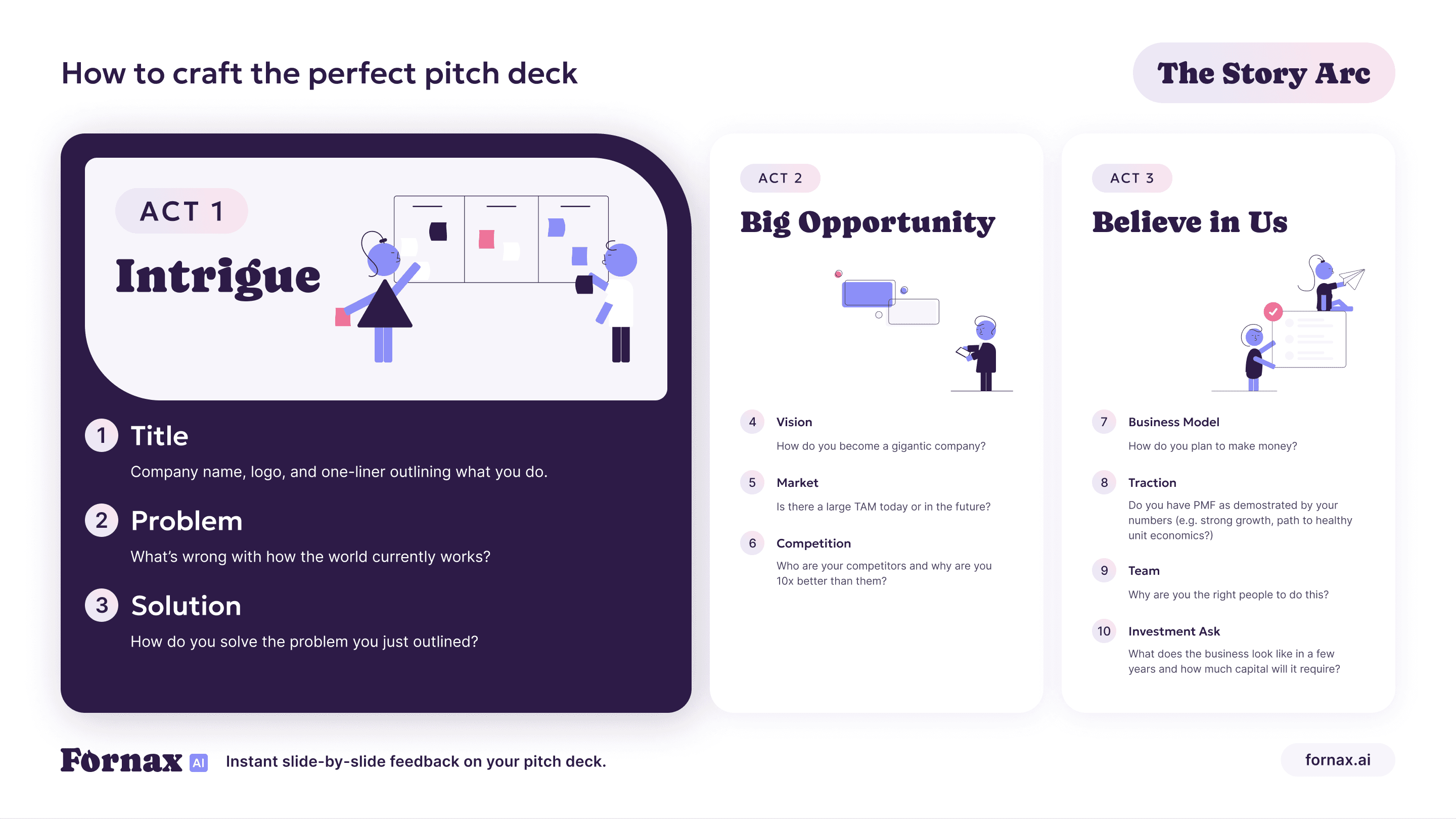

In this guide, we'll walk you through the process of crafting the perfect pitch deck, breaking it down into three acts, much like a great story. Each act serves a unique purpose, leading investors through your narrative and ultimately persuading them to invest.

Act 1: Intrigue – Capturing Investor Attention

The first act of your pitch deck is all about building excitement. You need to hook your audience from the very start, demonstrating that you've identified a significant, urgent, and painful problem, and that your startup has the solution.

1. Title Slide

Your title slide is your first opportunity to make a lasting impression. It sets the tone for the entire presentation and can determine whether investors lean in or tune out. Your title slide should include a statement that encapsulates your startup's essence—one concise sentence, no longer than ten words, that immediately conveys what your startup does.

✅ Do: Get to the point.

Example: "Book rooms with locals rather than hotels."

❌ Don’t: Use superlatives that don’t convey anything.

Example: "The next generation of travel."

The simplicity and clarity of your title are crucial because it’s the first thing investors see. It should create immediate interest and set the stage for the problem and solution you are about to present.

2. Problem Slide

The problem slide is where you demonstrate that you've identified a problem that is real, painful, and large. The problem should be easily understandable and relatable to your audience. Avoid niche jargon or overly complex issues that might be difficult for a broader audience to grasp. There is always a way to simplify a complex issue.

Using statistics, trends, or real-world examples, illustrate the magnitude of the problem. Instead of saying, "A friend of mine struggles to find affordable childcare," which is a personal anecdote, you might say, "Nearly 60% of working parents report that the high cost of childcare is a significant financial burden." The latter statement presents the problem as widespread and impactful, making it more compelling to investors.

It’s important to make the problem feel tangible and pressing. The more investors can relate to the problem, the more likely they are to see the value in your solution. Highlighting the size and impact of the problem also sets the stage for why your startup's solution is necessary and timely.

3. Solution Slide

After presenting the problem, it's time to introduce your solution. This slide should clearly and concisely present how your startup resolves the problem effectively. Convince investors that your approach is not only viable but superior to existing alternatives.

Emphasize what makes your solution unique and why it stands out in the market. This could be innovative technology, a unique business model, or a novel approach to a common issue. Avoid technical jargon or overly complex descriptions—the goal is to make your solution easily understandable for anyone, not just experts in your field.

Visual aids like diagrams, flowcharts, or before-and-after scenarios can be incredibly effective in illustrating how your solution works. These visuals help investors grasp the impact of your solution quickly and effectively. For example, if your solution involves a new piece of technology, a simple diagram showing how it integrates into existing systems can be far more persuasive than a lengthy technical explanation.

Conclusion of Act 1

The first three slides—title, problem, and solution—should hook investors and set the stage for the next act: the Big Opportunity. By now, your investors should be intrigued, understanding the problem and how your startup proposes to solve it.

The next step is to show them the massive potential for growth and returns.

Act 2: The Big Opportunity – Showing the Potential for Massive Growth

In the second act, your goal is to convince investors that your startup represents a massive opportunity. You need to show them that your startup has the potential to deliver a significant return on their investment.

4. Vision and Why Now Slide

This slide is more than just a statement of purpose; it’s a strategic play to show investors that your startup is ahead of the curve, seizing a unique opportunity at just the right time. Your vision should leave investors with a clear understanding of your long-term aspirations and why they should get on board now.

Explain not only where you are going but why this journey needs to begin today. It's about creating a sense of urgency and demonstrating foresight. Highlight the broader impact you want to have and why now is the perfect time for your startup. The timing could be due to technological advancements, market shifts, emerging needs, or societal changes—show that your startup is at the forefront of a significant trend or shift.

For instance, if your startup is leveraging AI, discuss why now is the time to invest in AI-driven solutions due to recent advancements in technology and increasing adoption across industries. This helps create a narrative that your startup is not just solving a problem, but doing so at the perfect moment, maximizing potential success.

5. Market Slide

The market slide is crucial because it showcases the opportunity your startup is addressing. This slide should clearly articulate the size and potential of the market, backed by data and trends. A well-crafted market slide not only provides evidence of a lucrative opportunity but also positions your startup as the solution poised to capitalize on this opportunity.

Start by defining your target market clearly. Specify whether you are focusing on a particular geographic region, demographic, or industry. Being specific helps investors understand your focus and strategy. For instance, if your product is designed for the healthcare industry, clearly state whether it’s for hospitals, clinics, or home care, and which geographic regions you are targeting.

Quantify the market size using reliable sources to present current market size and projected growth. This should include Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM), expressed in dollar values rather than the number of users. Investors want to see a large enough market to justify a great investment opportunity.

Discuss key trends and dynamics in the market. Are there emerging technologies, shifting consumer behaviors, or new regulatory environments that are reshaping the market? Assess metrics like market size, growth potential, and signs of market validation.

For instance, if you are targeting the electric vehicle (EV) market, discuss how the growth in EV adoption, supported by government incentives, is expanding the market rapidly, making it a lucrative area for investment. Use charts, graphs, and infographics to make the data more digestible and impactful. Visual representation of market data can make your arguments stronger and more memorable.

6. Competition Slide

The competition slide shows investors that you understand your competitive landscape and have a clear plan to distinguish and position your company for success. Avoid presenting a feature comparison with competitors or using a "quadrant" graph that miraculously places your startup in the top right. Instead, focus on how you are a category leader and what makes you 10x better than anyone else.

This is your opportunity to highlight your unique value proposition. Show investors that you have a deep understanding of your competitors and that you have a plan to differentiate your startup effectively. Discuss the competitive landscape—who are your main competitors, what are their strengths and weaknesses, and how does your product or service surpass what is currently available?

For example, instead of simply listing features, you could present a narrative that explains how your startup solves a fundamental issue that competitors overlook. If your product offers superior user experience, explain how this translates into higher customer retention or faster adoption rates. This approach not only differentiates you from competitors but also shows that you are thinking strategically about your market position.

For example, if your startup is a fitness app that rewards users for performing various tasks, you could say:

"Our app is pioneering a new category by gamifying fitness, which no other platform provides, resulting in an increase in user engagement and long-term retention."

Conclusion of Act 2

By the end of Act 2, investors should have a clear understanding of the massive opportunity your startup represents. You've shown them that there's a significant market, that you're positioned to capitalize on it, and that your solution offers a distinct advantage over the competition.

Now, it's time to seal the deal by demonstrating your business model, traction, team strength, and the specifics of your investment ask.

Act 3: The Close – Sealing the Deal

The final act is where you tell investors why they should back you. This is where you detail your business model, demonstrate traction, introduce your team, and make the ask for investment.

7. Business Model Slide

The business model slide is not just about showing that your startup can generate revenue; it's about demonstrating that you have a thoughtful and sustainable approach to building a profitable business. By clearly articulating your revenue streams and growth potential, you can make a strong case for the viability of your venture.

Identify and describe the primary sources of revenue for your startup, whether through direct sales, subscription models, advertising, or a combination of streams. Make it clear how money flows into your business. For instance, if you are running a tSaaS business, explain your pricing strategy, subscription tiers, and customer acquisition cost (CAC) compared to lifetime value (LTV).

Discuss how your business model supports scalability and growth, something investors are particularly interested in. If your business relies on network effects or has low marginal costs as it scales, make sure to highlight these points. Investors want to see that as you grow, your business becomes more efficient and profitable.

For example, if your startup is in the e-commerce space, explain how your business model leverages drop shipping to reduce overhead and increase scalability. This not only shows that your business is capable of growing but also that it can do so efficiently.

8. Traction Slide

A well-crafted traction slide is crucial in building investor confidence. It's a blend of data and narrative that demonstrates your startup's growth, resilience, and potential. This slide isn’t just about what you’ve achieved; it's about showcasing your upward trajectory and reinforcing the belief that your startup is a wise investment.

Focus on metrics that truly reflect your growth, such as customer acquisition, revenue growth, or user engagement. For example, instead of just listing the number of app downloads, highlight active users, retention rates, or revenue per user—these metrics give a clearer picture of your startup’s actual performance.

Provide a timeline or graph that shows your growth trajectory. This visual representation makes it easier for investors to understand and appreciate your progress. For instance, a graph showing month-over-month revenue growth or a timeline of major milestones (like launching a new product or entering a new market) can be very persuasive.

Traction demonstrates that your startup is not just an idea—it’s a growing business with real momentum. It reassures investors that there is demand for your product and that you have the capability to scale.

9. Team Slide

The team slide is your chance to shine a spotlight on the most crucial asset of your startup—its people. By effectively showcasing the experience, expertise, and passion of your team, you can build investor confidence in your ability to execute your business plan. Remember, investors don't just invest in ideas; they invest in people.

This slide should do more than just list names and titles; it needs to communicate the collective capability and commitment of your team to turn the startup's vision into reality. Focus on the core team members, including founders and key leadership roles. Provide a brief overview of their background, emphasizing experiences and skills relevant to the startup's success.

Link each team member's experience directly to their role within the startup. Highlight previous accomplishments, industry expertise, and any unique skills that contribute to the startup's competitive advantage. For instance, if your CTO has previously scaled a tech company, mention this as it shows that they have the expertise needed to grow your startup.

Use professional but approachable photos of team members to add a personal touch—this helps investors feel a connection to the people behind the startup. A cohesive, well-rounded team can significantly enhance the credibility of your startup and the likelihood of securing investment.

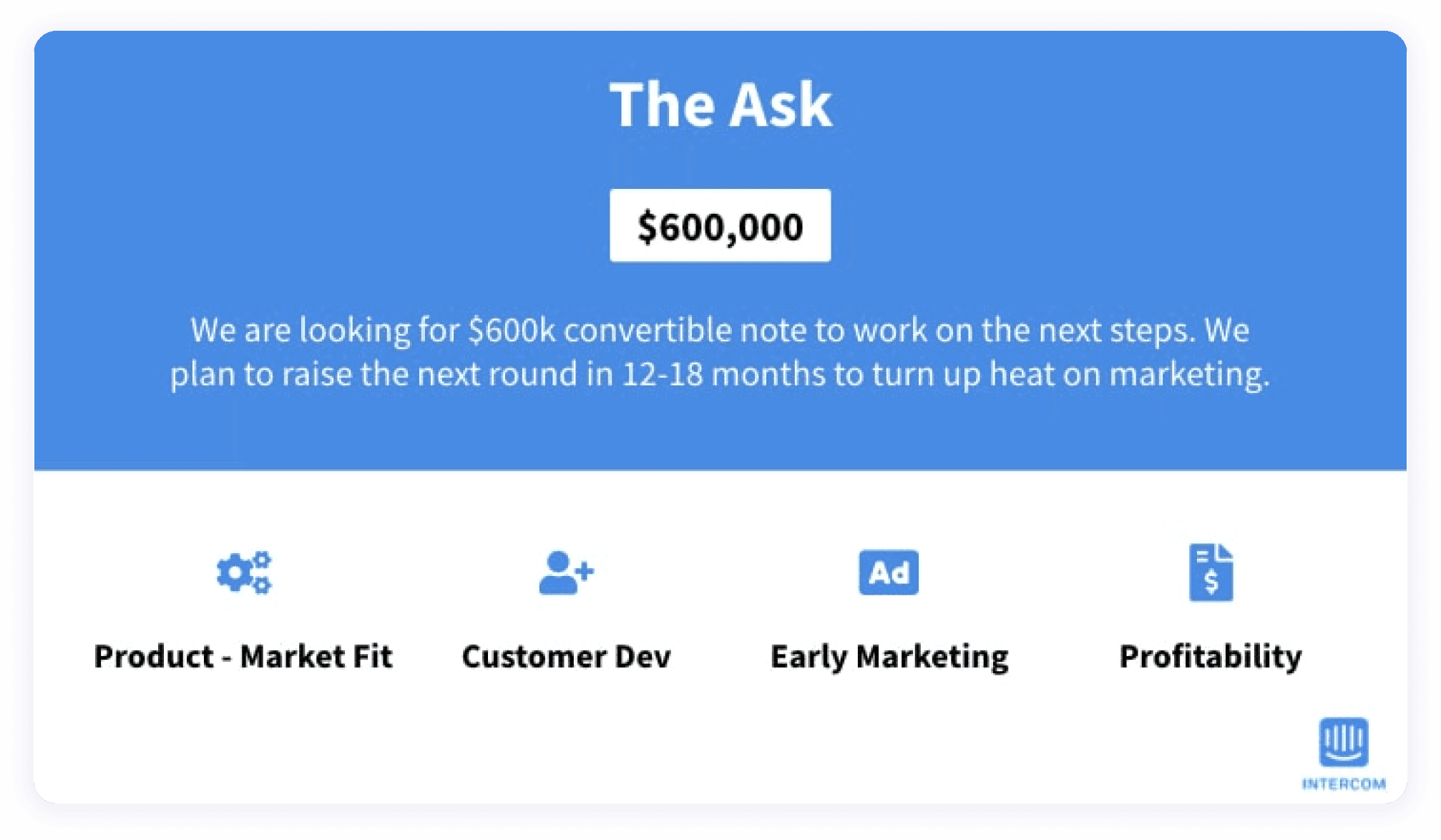

10. Investment Ask Slide

The investment ask slide serves to transparently communicate your funding needs and how the investment will propel your startup forward. It's not just about stating a number; it's about building confidence in your strategic financial planning and growth projections.

Clearly state the amount of funding you are seeking, ensuring the figure aligns with your financial projections and growth strategies. Break down how the investment will be utilized, detailing key areas like product development, marketing, hiring, or expansion efforts. This demonstrates that you have a strategic plan for the investors' money.

Connect the use of funds to expected outcomes. For example, illustrate how funding marketing efforts will lead to increased brand awareness and customer acquisition. This helps investors visualize the growth their investment will fuel.

If appropriate, outline any proposed terms of the investment, such as the type of equity or debt being offered, valuation, and other key terms. Be prepared to negotiate these terms in discussions following your pitch.

Show how the investment will help you reach critical milestones, such as product launches, market expansions, or sales targets. This reassures investors that their funding will contribute to significant progress and ultimately drive the return on investment they are seeking.

Conclusion

Crafting the perfect pitch deck is about more than just presenting information—it's about telling a compelling story that draws investors in and makes them believe in your vision. By structuring your pitch deck into three acts—Intrigue, Big Opportunity, and The Close—you can guide investors through your narrative, building excitement, demonstrating potential, and ultimately convincing them to invest in your startup.

Remember, often the difference between raising capital and falling short is your ability to tell a great story. Make sure that your pitch deck tells a compelling story that investors want to hear, one that they can’t wait to be a part of.

One final thing to remember is that investors spend less than 3 minutes per deck, so make sure you are concise and straight to the point. Try Fornax today and get instant actionable feedback to improve your pitch deck.