Sep 9, 2024

2024 Pitch Deck Insights: How to Adapt Your Pitch Deck to Win Investors’ Attention

As we progress through 2024, the landscape of startup fundraising continues to evolve at a rapid pace. For founders looking to secure investment, understanding the latest trends in pitch deck metrics is crucial.

The data is accurate up to August 30, 2024 - keep checking back here periodically as we will update the numbers as the year goes on!

Summary of Pitch Deck Data

The TL;DR version of this blog post is:

Investor Engagement Up by 13%: Investor interest in pitch decks has significantly increased compared to 2023, signaling a more favorable investment climate.

Time Spent on Decks Decreased by 3.85%: Investors are spending less time reviewing pitch decks, emphasizing the need for concise, impactful presentations.

Steady Founder Activity: Despite the competitive landscape, founder activity remains consistent.

Shorter Decks Outperform Longer Ones: Pitch decks that are clear, concise, and less narrative-heavy are seeing up to 15% more engagement than longer presentations.

Read on to see what you can do to adapt to the latest trends and ensure your pitch deck gets noticed amongst the increased competition!

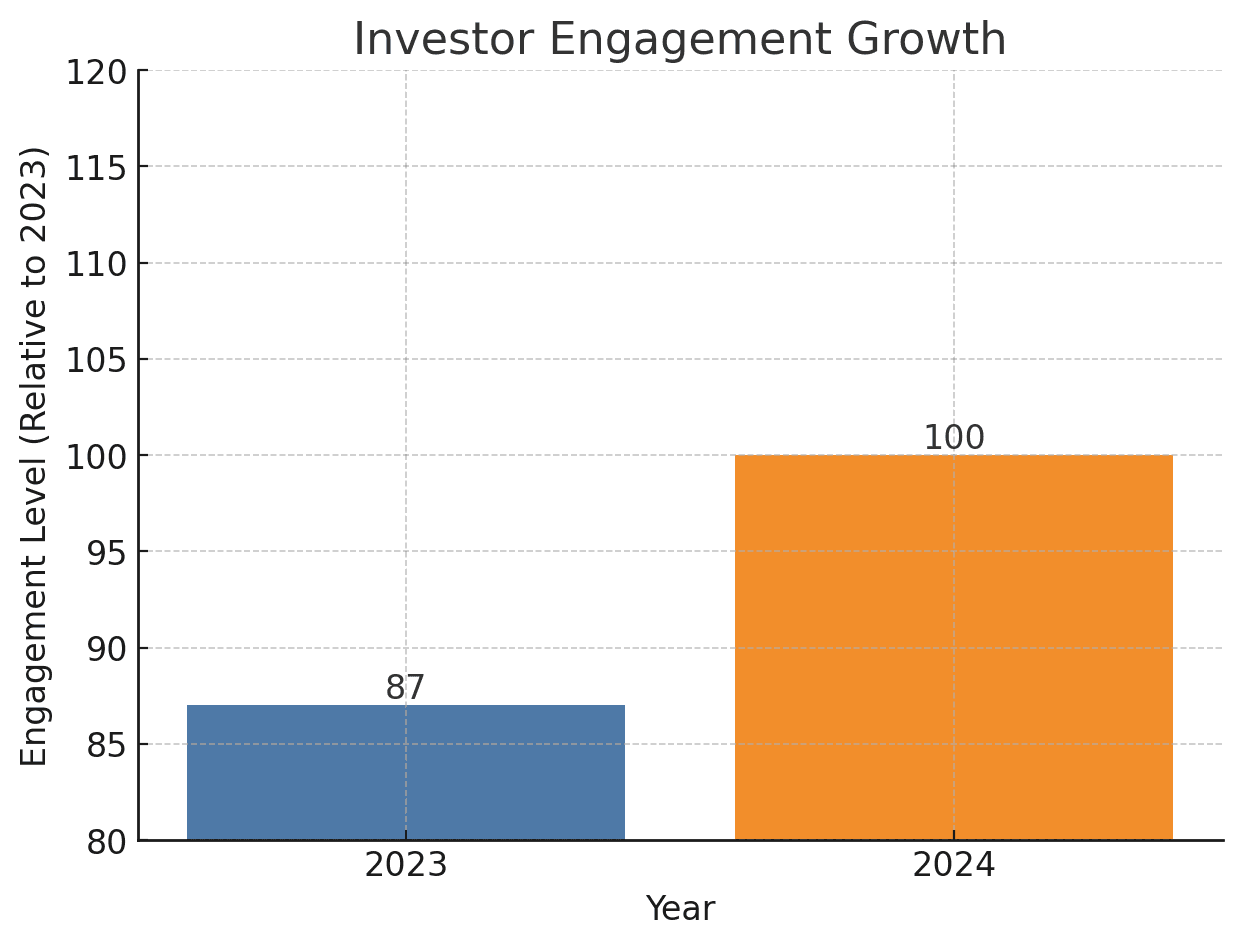

Investor Engagement: A Strong Surge

One of the most significant trends of 2024 is the substantial increase in investor engagement. Compared to 2023, investor interest in pitch decks has surged by 13%. This uptick signals a positive shift in the market, with investors actively seeking out new opportunities. But what does this rise in engagement mean for startups?

In 2023, investor engagement levels were more tempered, likely due to a cautious market outlook influenced by global economic uncertainties. As we entered 2024, however, the economic landscape began to stabilize, and investor confidence rebounded. This renewed confidence is evident in the increased number of pitch decks being reviewed and the heightened activity within investment circles.

For startups, this surge in investor interest presents a prime opportunity to secure funding. However, it also means that competition is fiercer than ever. With more investors on the hunt for promising startups, founders must ensure that their pitch decks stand out in a crowded field. The key to capitalizing on this trend lies in understanding what investors are looking for and tailoring your pitch to meet those expectations.

Investor Engagement Over Time

To illustrate this growth in investor engagement, consider the graph above. It highlights the year-over-year increase in engagement, showing a clear rise in activity from 2023 to 2024.

The 13% increase marks a significant improvement from the previous year, making it more important than ever to capture investors' attention quickly and effectively. This growth is particularly noteworthy considering the more cautious investment environment of 2023, where economic uncertainties made investors more selective.

What Does This Mean for Startups?

For startups, this increased engagement means a larger pool of potential investors, but also more competition. The heightened interest from investors doesn’t just indicate more opportunities; it also implies that your pitch deck needs to be even more polished and impactful to stand out.

This trend also suggests that investors are actively looking for innovative solutions in the market, making it a critical time to pitch if your startup aligns with emerging industry trends. For example, sectors such as AI, clean energy, and health tech have seen increased interest from investors. Ensuring your pitch deck highlights how your startup is part of these high-growth areas could give you an edge.

Time Spent on Decks: Efficiency Is Key

While investor interest is on the rise, the average time spent reviewing pitch decks has decreased slightly. In 2024, investors are spending an average of 2 minutes and 21 seconds on each deck, down 3.85% from the 2 minutes and 27 seconds they spent in 2023. This decrease may seem minor, but it highlights a crucial shift in investor behavior: efficiency is becoming increasingly important.

Average Time Spent on Decks

The graph above shows the slight decrease in time spent on decks from 2023 to 2024. Investors are making quicker decisions, likely due to the higher volume of pitches they are receiving. This shift indicates a growing preference for concise, data-driven pitches that get to the point quickly.

Implications for Your Pitch Deck

In today’s fast-paced investment environment, investors are flooded with pitch decks. As a result, they’ve become more selective and are making quicker decisions. The days of lengthy, detailed pitch decks are fading, replaced by a preference for concise, impactful presentations that quickly convey the startup's value proposition.

For founders, this trend underscores the importance of brevity and clarity. With less time to capture an investor’s attention, every second counts. Your pitch deck needs to communicate the most critical aspects of your business—the problem you’re solving, your solution, the market opportunity, and the strength of your team—within the first few slides. If your deck can’t hook an investor within the first minute, you risk losing their interest altogether.

Best Practices for a Time-Efficient Pitch Deck

To adapt to this trend, consider the following strategies:

Lead with a Strong Value Proposition: Make sure your pitch opens with a clear and compelling statement about the value your startup provides. This should be concise and directly address the problem your startup is solving.

Use Data Wisely: Investors are looking for evidence that your business model is viable. Use data to support your claims, but avoid overwhelming them with too much information. Highlight key metrics and growth projections, but keep it focused.

Visual Appeal Matters: A well-designed pitch deck not only looks professional but also makes information easier to digest. Use visuals, charts, and infographics to communicate complex ideas quickly and clearly.

Practice the Elevator Pitch: Imagine you only have 30 seconds to pitch your startup. What would you say? This exercise can help you distill your message and ensure that your pitch deck gets to the point quickly.

Incorporating these best practices can help ensure that your pitch deck is not only informative but also engaging enough to capture an investor's interest quickly.

Founder Activity: Consistency in a Competitive Landscape

Founder activity, which is measured by the number of pitch decks sent out and the frequency of updates provided to investors, has remained steady in 2024.

Founder Activity Levels

The graph above highlights how founder activity has remained stable over the past year. This consistency indicates that startups are actively pursuing investment opportunities, even as the market becomes more competitive.

Why Steady Founder Activity Matters

In a market where investor interest is rising, but time spent on individual decks is declining, maintaining a steady level of activity is crucial. Consistent outreach ensures that your startup remains on investors' radars, even as they sift through an increasing number of pitches.

However, it's not just about sending out more pitch decks; it's about the quality and timing of your outreach. Founders who are strategic in their approach—targeting the right investors, providing timely updates, and tailoring their pitches to the investor’s interests—are more likely to stand out.

Here’s how you can ensure your activity remains effective:

Targeted Outreach: Focus on investors who have a history of investing in your industry or stage of development. Personalized pitches that align with the investor’s portfolio are more likely to get noticed.

Regular Updates: Keep potential investors informed about your progress. Whether it's a new product launch, a significant partnership, or hitting a key milestone, regular updates can keep the conversation going and demonstrate your startup’s momentum.

Refine Your Pitch: Each time you send out your pitch deck, take the opportunity to refine it based on feedback and new developments. A pitch deck should be a living document that evolves with your business.

Consistency in founder activity doesn't just keep your startup visible; it also builds trust with investors. It shows that you are committed, resilient, and proactive—qualities that are highly valued by investors.

The Rise of Shorter, Less Narrative-Heavy Decks

One of the most notable trends in 2024 is the performance of shorter, less narrative-heavy pitch decks. These decks, which focus on delivering clear, concise information with minimal fluff, are outperforming more detailed, longer pitch decks by as much as 15%.

Performance of Shorter Decks

The graph above illustrates how shorter decks are faring better compared to longer ones. This trend is particularly important in light of the decreased time investors are spending on each pitch deck.

Why Investors Prefer Shorter Decks?

The answer lies in investor behavior. With more pitch decks to review and less time to spend on each one, investors are gravitating towards presentations that get straight to the point. A deck that can convey the startup’s potential in a few slides is more likely to hold an investor’s attention and prompt further interest.

This shift doesn’t mean that storytelling is no longer important. But the way the story is told is changing. Instead of lengthy narratives, founders are now using data-driven storytelling that focuses on key metrics, market opportunities, and the strength of their team. Investors are looking for concise narratives backed by hard evidence.

How to Create a Short, Impactful Deck

To craft a shorter, more effective pitch deck, consider the following tips:

Focus on Key Metrics: Investors want to see evidence of traction and potential. Highlight your most impressive metrics—customer growth, revenue projections, market size—early in the deck.

Trim the Fat: Go through your pitch deck slide by slide and ask yourself: does this slide add value? If not, cut it. Every slide should serve a clear purpose and drive your narrative forward.

Visual Storytelling: Use visuals to replace lengthy text. Charts, infographics, and images can often convey information more effectively than paragraphs of text.

The success of shorter decks highlights a broader trend in communication: brevity is not just a nice-to-have, it’s a necessity. In an environment where time is at a premium, the ability to communicate complex ideas succinctly is a powerful skill.

Final Takeaways for your Fundraising Strategy:

Investors are looking for concise, data-driven presentations. Tailor your pitch deck to meet these expectations by focusing on key metrics, using visual storytelling, and trimming unnecessary content.

Consistency is important, but so is targeting the right investors and providing regular updates. Personalized outreach combined with strategic follow-ups can help you stand out in a crowded field.

The fundraising landscape is always changing. Stay informed about the latest trends and be willing to adapt your strategy as needed. A pitch deck should be a living document that evolves with your startup’s growth and the changing expectations of investors.

2024 is shaping up to be a dynamic year for startup fundraising. By staying ahead of these trends and refining your pitch deck strategy to adapt, you can increase your chances of capturing investor interest and securing the funding you need.

Remember to continue to check back here as we will update this post over time!